Budgeting 101 - Master the Art of Personal Finance

Why Budgeting Matters

Imagine your finances as a road trip: would you start without a map or GPS? Of course not! Budgeting is the financial GPS that helps you navigate the route to financial success. In this Budgeting 101 guide, we’ll teach you the ins and outs of creating a realistic budget and sticking to it. Let’s dive in!

Key Takeaways on How to Make a Budget and Save Money

- Understand your monthly after-tax income and categorize your expenses into fixed, variable, and irregular.

- Choose a budgeting method, like zero-based budgeting or the envelope system, and use a spreadsheet or a budget app to track your spending.

- Regularly evaluate and adjust your budget, set savings goals, and prioritize debt repayment.

- Build an emergency fund.

- Make budgeting a habit and stay committed to your financial goals for long-term success.

Understanding Your Income and Spending Habits

Determine Your Monthly After-Tax Income

To begin your budgeting journey, you first need to determine your monthly after-tax income. This is the actual amount you have available to allocate toward expenses, savings, and other financial goals. Your after-tax income, also known as your take-home pay, is the net amount you receive each month after various deductions have been taken out. These deductions include taxes, retirement contributions, health insurance premiums, and other mandatory expenses.

To accurately calculate your monthly net income, start by reviewing your pay stubs or bank statements. These documents will show your gross income (your total earnings before deductions) and the various deductions applied to your salary. By subtracting the deductions from your gross income, you’ll arrive at your monthly after-tax income.

If you have multiple sources of income, such as a side job or rental property, be sure to include these amounts in your calculations.

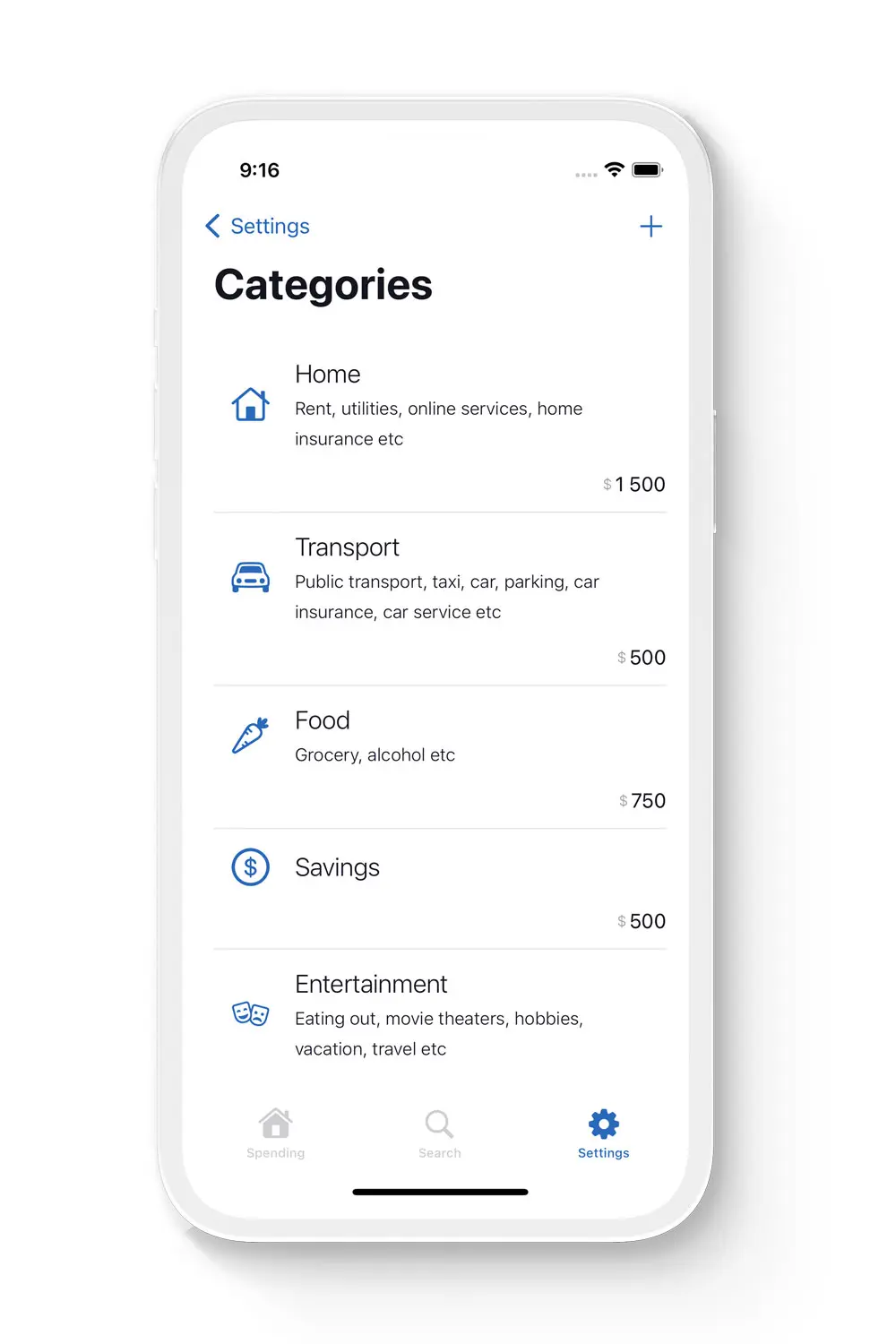

Categorize Your Expenses

Categorizing your expenses is essential because it allows you to have a clear understanding of where your money is going. By breaking down your monthly expenses into different categories, you can easily identify areas where you can save. There are three main types of expenses you’ll need to consider: fixed, variable, and irregular.

Fixed expenses

Fixed expenses are the consistent, recurring costs you pay every month. Examples of fixed expenses include rent or mortgage payments, car loans, and insurance premiums. These expenses generally do not change from month to month, making them predictable and easier to plan for in your budget. When calculating your fixed expenses, be sure to account for all your regular monthly obligations, as they form the basis of your spending limits.

In addition to monthly expenses, fixed expenses can also be incurred annually. An annual expense is an expense that occurs only once a year. These expenses are typically predictable and recur at the same time each year. They can include items such as property taxes, insurance premiums, vehicle registration fees, and annual subscription or membership fees.

By setting aside funds throughout the year, you can ensure you’re prepared to cover these expenses when they arise, without causing strain on your monthly budget.

Variable expenses

Variable expenses, on the other hand, fluctuate each month depending on your usage and lifestyle choices. These expenses include items such as groceries, transportation, utilities, and entertainment.

Since these costs can vary, you’ll need to monitor your spending closely and adjust your budget as necessary. Keep track of your variable expenses and look for areas where you can cut back, like eating out less or reducing your discretionary spending.

Irregular expenses

Irregular expenses are those that do not occur on a monthly basis but can still have a significant impact on your budget. Examples of irregular expenses include annual property taxes, holiday gifts, or unexpected car repairs. While these expenses might not happen every month, it’s important to plan for them in your budget. Set aside a portion of your money each month to cover these costs when they arise.

Tip

Note that some expenses might not fit neatly into one of these spending categories. For example, you might have other expenses that are less predictable, like medical bills or home repairs. In these cases, it’s a good idea to create a separate category for these types of expenses in your budget.

Remember, the more detailed your expense categories are, the better you’ll be able to understand where your money is going and make informed decisions about your budget.

Calculate Your Monthly Spending Limits

Begin by examining your fixed expenses. Since these costs are consistent, it’s relatively easy to allocate a portion of your monthly income to cover them.

Next, consider your variable expenses. These costs can be more challenging to budget for since they fluctuate from month to month. Begin by examining your past spending, using your bank account statements to establish an average amount for each variable expense. Then, set a spending limit for each category based on your average spending and your personal budget priorities.

Keep in mind that you may need to adjust these limits as your spending habits change or as your financial situation evolves.

It’s essential to strike a balance between spending money on necessities and saving for the future. To do this, allocate a portion of your monthly income towards savings and investments.

Tip

Experts often recommend setting aside at least 20% of your income for these purposes. However, you may need to adjust this percentage based on your unique circumstances.

Now that you have a clearer understanding of your monthly expenses and how they relate to your income, you can begin to make a budget. A household budget should include all your fixed and variable expenses, as well as any irregular expenses you may encounter. This will help you see the bigger picture of your financial situation and make better-informed decisions about your spending habits.

As you calculate your spending limits, remember to be realistic and flexible. Life is full of surprises, and you may need to adjust your budget to accommodate unexpected expenses or changes in your income.

Regularly review your budget and make necessary adjustments to ensure you’re allocating enough money to cover your expenses while still saving for your goals.

Crafting Your Personal Budget

Choose a Budgeting Method

There are several methods to choose from, each with its own set of advantages and drawbacks. The key is to find a method that works for you and makes it easy to track and manage your personal budgeting.

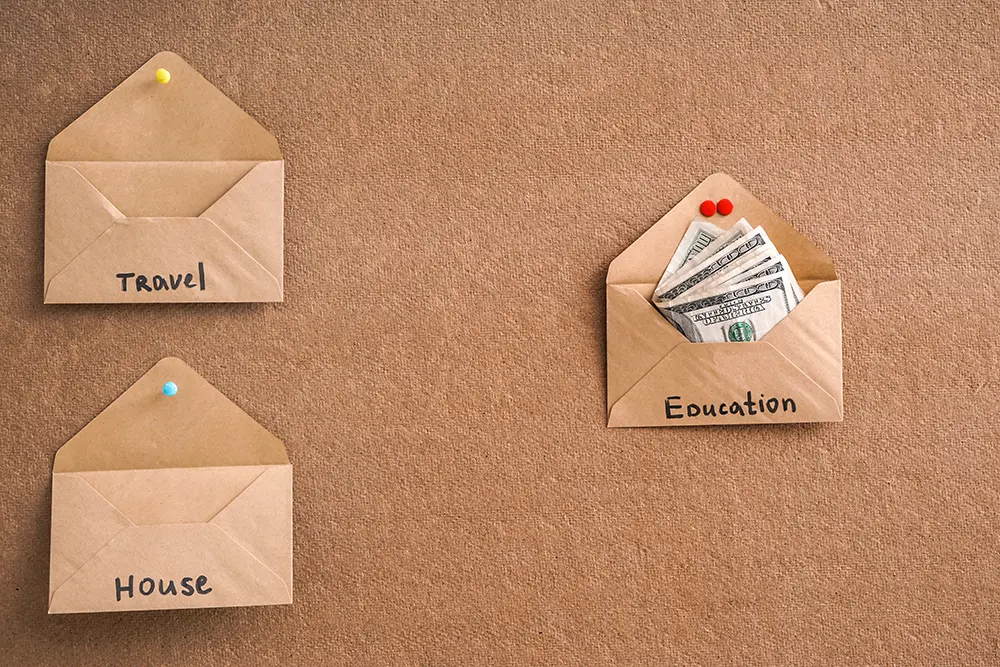

One popular approach is the envelope system. This method involves dividing your cash into physical envelopes for each of your major categories, like groceries, utilities, and entertainment.

You only spend what’s in each envelope for that category, and once it’s empty, you can’t spend any more in that area until the next month. This method can be highly effective for people who prefer a tangible way of managing their spending and want to focus on curbing impulsive buying.

Another widely-used method is zero-based budgeting. With this approach, you allocate every dollar of your income to a specific purpose, ensuring that your income minus all your expenses equals zero. This method encourages you to scrutinize every aspect of your spending and make adjustments as needed. It can be highly effective for those looking to gain a comprehensive understanding of their financial situation and take full control of their money.

A more flexible option is the 50/30/20 rule, which involves allocating 50% of your income to necessities, 30% to discretionary spending, and 20% to savings and debt repayment. This method provides a simple framework for dividing your income while still allowing for some flexibility in how you spend your money. It’s an excellent option for those who are new to budgeting and want a straightforward starting point.

Consistency

Regardless of the method you choose, the most important aspect of making a budget is consistency. Regularly track your spending and update your budget to reflect changes in your income, expenses, or financial goals. This will help you stay on top of your finances and make better decisions about how to allocate your money.

As you implement your chosen budgeting method, remember to be patient with yourself. Adjusting to a new budget can take time, and you may need to tweak your approach as you learn more about yourself. The key is to remain committed to the budgeting process and consistently work towards improving your financial health.

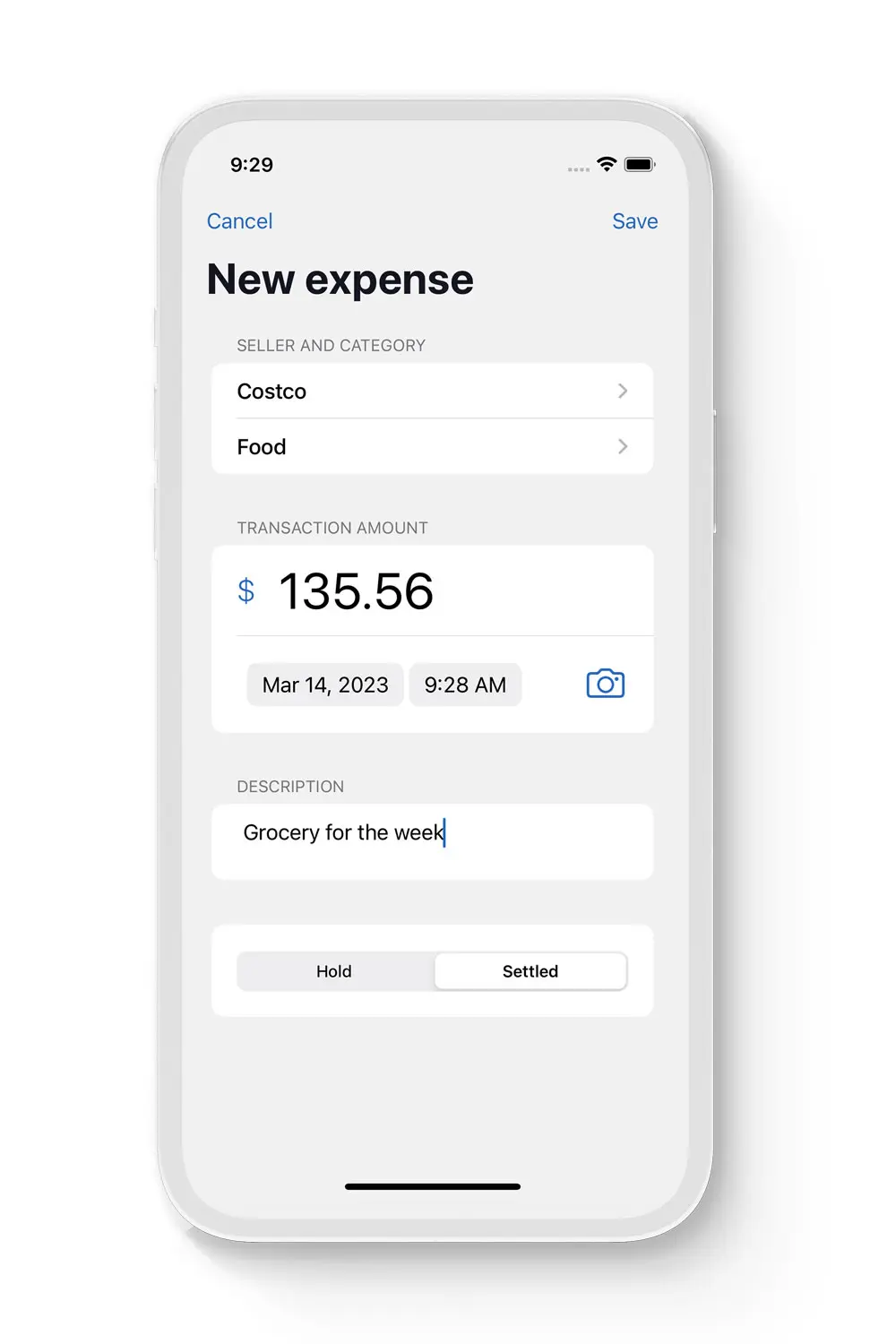

Track Your Spending

Tracking your spending is a crucial aspect of successful budgeting, as it enables you to gain a clear understanding of where your money is going and identify areas where you can save. By consistently monitoring your expenses, you’ll be better equipped to make informed decisions about your finances, stick to your budget, and ultimately achieve your goals.

One way to track your spending is by keeping receipts for all your purchases and reviewing them at the end of each week or month. This will help you see exactly where your money is going and allow you to identify any patterns or areas where you might be overspending. For example, if you notice you’re consistently spending more on dining out than you budgeted for, you can adjust your habits or your budget accordingly.

Another effective method for tracking your spending is by using a budgeting app, budget spreadsheet, or Google Sheets.

Adjusting and Refining Your Budget

Evaluate and Adjust Your Spending Limits

Regularly review your spending and compare them to the limits you’ve set for each category. This will allow you to identify areas where you may be overspending and make adjustments as needed.

Be prepared to make changes to your spending limits as your financial situation evolves, or if you find that your initial limits were too restrictive or lenient.

Continuously refining your budget ensures that you maintain a realistic and effective plan for managing your finances and maximizing your savings potential.

Plan for Irregular Expenses

These expenses can include things like vehicle maintenance, unexpected health care costs, or occasional large purchases. By anticipating and setting aside funds for these expenses, you’ll be better prepared to handle them without causing undue strain on your budget.

One approach is to create a separate savings account dedicated to irregular expenses, depositing a predetermined amount each month. This way, when an unexpected arises you’ll have a financial cushion in place to cover it, minimizing the impact on your overall budget.

Set Savings Goals

Setting specific and realistic savings goals is a powerful motivator that can encourage you to be more diligent about saving money.

Whether you’re saving for a down payment on a house, a dream vacation, or building an emergency fund, having clear objectives in mind will help you stay focused and committed to your financial plan.

To achieve your savings goals, allocate a portion of your monthly income towards each goal and track your progress regularly. This will not only keep you accountable but also provide you with a sense of accomplishment as you watch your savings grow and move closer to reaching your financial objectives.

Prioritize Debt Repayment

Prioritizing debt repayment is a crucial aspect of successful budgeting, as it can save you money in interest payments and improve your overall financial health. Focus on paying off high-interest debts first, such as credit cards or car payments, to minimize the total amount you pay over time.

Incorporate debt repayment into your budget by allocating a portion of your income specifically for this purpose. As you pay down your debts, you’ll free up more funds for other financial goals and eventually save money. Stay committed to your debt repayment plan to experience the long-term benefits of a debt-free life.

Trim Your Expenses

Start by identifying areas where you can cut spending without significantly impacting your lifestyle. For example, you could save on grocery shopping, using coupons, or cooking at home more often to save money.

Another area to consider is reducing your utility bills, such as your water bill. Simple changes like fixing leaks, installing low-flow fixtures, or being more mindful of your water usage can lead to noticeable savings.

Build an Emergency Fund

An emergency fund serves as a safety net, providing you with extra money to cover unexpected expenses like medical bills, car repairs, or job loss, without derailing your budget or forcing you to rely on high-interest debt.

To create your emergency fund, set a goal for how much you’d like to save, ideally enough to cover three to six months of living expenses.

Allocate a portion of your monthly income towards this goal and deposit the funds into a separate savings account. Over time, this will provide you with peace of mind and financial security in the face of life’s uncertainties.

Make Budgeting a Habit

Consistency is key to successful budgeting. Review and update your budget regularly, and make adjustments as needed. Celebrate your financial achievements, like reaching a savings goal or paying off debt.

Reward Yourself

Rewards help keep you motivated and committed to your budget. By setting milestones and treating yourself when you achieve them, you’ll feel a sense of accomplishment and be more likely to continue making progress.

These rewards don’t have to be extravagant or expensive. It could be something as simple as enjoying a special meal at home or indulging in a small luxury. The key is to choose a reward that feels meaningful and gratifying to you, reinforcing the positive habits you’ve developed while working towards your financial objectives.

Conclusion

Budgeting is the cornerstone of personal finance. By understanding your income and expenses, setting realistic spending limits, and making adjustments as needed, you can take control of your financial future. Stick to your budget, stay focused on your goals, and watch your wealth grow.